There are what seems like countless hindrances to subrogation recovery. With a spin on Elizabeth Barrett Browning’s famous love poem for the title of this article, we delve broadly into the legal bars for recovery. The non-exhaustive list below outlines some of the main legal doctrines barring recovery in insurance claims. Hopefully, these simple definitions can assist in evaluating your next loss. Please note, the definitions are not state specific and just provide a general overview of the doctrines; subrogation counsel will have state specific rules, exemptions, and variations that could apply.

There are what seems like countless hindrances to subrogation recovery. With a spin on Elizabeth Barrett Browning’s famous love poem for the title of this article, we delve broadly into the legal bars for recovery. The non-exhaustive list below outlines some of the main legal doctrines barring recovery in insurance claims. Hopefully, these simple definitions can assist in evaluating your next loss. Please note, the definitions are not state specific and just provide a general overview of the doctrines; subrogation counsel will have state specific rules, exemptions, and variations that could apply.

Statute of Limitations: Each state sets a time bar (commonly 1, 2, 3, or 4 years) from the date of the incident in which the carrier must file a civil lawsuit for damages. Any suit filed after the required time frame will be barred.

Statute of Repose: In addition to the Statute of Limitations, each state also sets a time bar (commonly 6, 8, or 10 years) for claims against a contractor for negligent construction, service, repair, installation, maintenance, etc. The time clock will begin either on the date of the service or the date the damage is discovered, depending on the type of service.

Economic Loss Doctrine: This doctrine states that a party cannot recover in a tort action against the manufacturer for product defect if the only damage is to the product itself (i.e., no personal injury or no other property damaged). For example, if a defect in an automobile or lawnmower caused fire damage to the product itself (the automobile or lawnmower) as well as the residence or neighbor’s fence, then this doctrine would not apply to bar pursuit of the manufacturer.

Implied Co-Insurance: Depending on the language of the lease agreement, some states provide that a tenant of a rental property is considered a co-insured under the landowner’s insurance policy. Combined with the Anti-subrogation principle stating that an insurance carrier has no right to assert a claim against its own insured, the carrier would be barred from pursuing any “co-insureds” or “additional insureds.”

Government Immunity: Despite apparent negligence of a fire department, police department or municipality in causing or contributing to a loss, state codes governing these agencies commonly provide immunity for their actions or inactions, thus barring pursuit for a loss.

Comparative Fault: Sometimes the insured’s own actions or inactions contribute to a loss. Each state sets a bar or modification to the amount of recovery against a third party tortfeasor depending on the amount of fault of the insured. Some states bar recovery completely if the insured was at fault, others only bar recovery if the insured was 50 percent or more at fault, and other states reduce the amount of recovery against the third party tortfeasor by the amount of the insured’s fault.

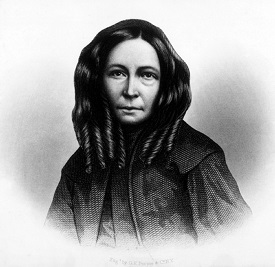

Of course, the “depth and breadth and height” (to steal a line from Browning’s poem) of these legal doctrines cannot be analyzed without the state specific laws and circumstances of the particular loss. Because most subrogation matters cannot be evaluated with a poetic ring, we leave you with the full text of Browning’s poem below.

How do I love thee? Let me count the ways

by Elizabeth Barrett Browning

(March 6, 1806 –June 29, 1861)

How do I love thee? Let me count the ways.

I love thee to the depth and breadth and height

My soul can reach, when feeling out of sight

For the ends of Being and ideal Grace.

I love thee to the level of every day’s

Most quiet need, by sun and candle-light.

I love thee freely, as men strive for right;

I love thee purely, as they turn from praise,

I love thee with the passion put to use

In my old griefs, and with my childhood’s faith.

I love thee with a love I seemed to lose

With my lost saints -I love thee with the breath,

Smiles, tears, of all my life! -and, if God choose,

I shall but love thee better after death.